DOE/EIA has a history of exaggerated oil production projections which news organization, such as NPR, never look at. Department of Energy/Energy Information Administration (U.S. In their world, oil production can always be made to go up irrespective of how much oil has been extracted from a field, play or region I suppose they get that idea from government agencies like the U.S. Slide Anything shortcode error: A valid ID has not been providedĪ taboo word for NPR news programs is depletion. I never heard NPR and other media sources ever present that angle of the tight oil industry during the heyday period. Reports put the fracking industry financial losses at over $300 billion from 2010 through 2020.

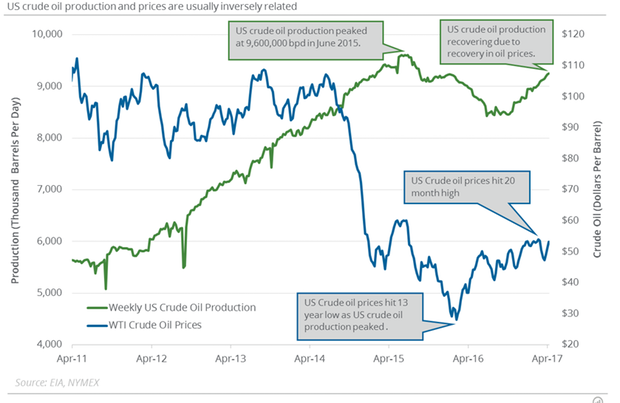

I would attribute the extent to which the industry is showing discipline in limiting the number of new wells to the lack of profitabilty within the tight oil industry, in general, during the heyday of development from 2008 to 2019. wells in 2021, versus 2020, by 15.4% with the number of Permian Basin wells increasing by 27.8% (the Permian Basin is the most prolific U.S tight oil play). With increasing oil prices in 2021, the industry was projected to increase the number of new U.S. The industry has to drill and complete new wells at a brisk pace just to maintain production at a constant rate. oil production would decline because much of the production comes from tight oil wells that decline rapidly. The problem with a measure like that is that U.S. The most effective measure to maximize price increases would be to stop all new U.S. Of course the oil industry prefers higher prices to increase profitability. But their goal is actually to maintain higher oil prices. oil industry could crank production up to whatever level they desire if that was their goal. The implication in the spin is that the U.S. oil industry is showing great discipline in holding production down to prop prices up. oil production rate for 2021 even though the price of oil was significantly higher than in 2020 and even 2019. National Public Radio (NPR) news programs put an interesting spin on the low U.S. crude oil + condensate production rate was only 11.19 mb/d, down 1.10 mb/d relative to 2019. In 2021, the price of West Texas Intermediate (WTI) oil increased significantly over 2020 and even beyond the value of 2019 (2019/2020/2021 average prices were $56.99/$39.16/$67.99/barrel) but the average annual U.S. To put 7.3 mb/d in perspective, only 2 countries, other than the U.S., produce over 5.0 mb/d of oil (Saudi Araba and Russia). Tight oil production increased approximately 7.3 mb/d from 2008 to 2019 and deep water GOM production increased approximately 0.67 mb/d. That increase was due to tight oil and deep water Gulf of Mexico (GOM) production increases. crude oil + condensate production increased significantly between 20. Typically, condensate represents less than 20% of the total crude oil + condensate production for a field or play. If graphs and tables in this report only include crude oil, that will be specified otherwise the data can be assumed to be crude oil + condensate. Government data for oil field production may represent crude oil or crude oil + condensate. Tight oil comes from the fracking of shale plays. Beyond the pandemic problems endured by oil producers, there were depletion problems as well, particularly for tight oil production. oil producers reduced drilling new wells and completing drilled wells, which contributed to a production declined to 11.28 mb/d on an annual basis in 2020. After the price of oil collapsed in April of 2020, U.S.

0 kommentar(er)

0 kommentar(er)